Overdraft Agreement 12 2. Grows as business expands.

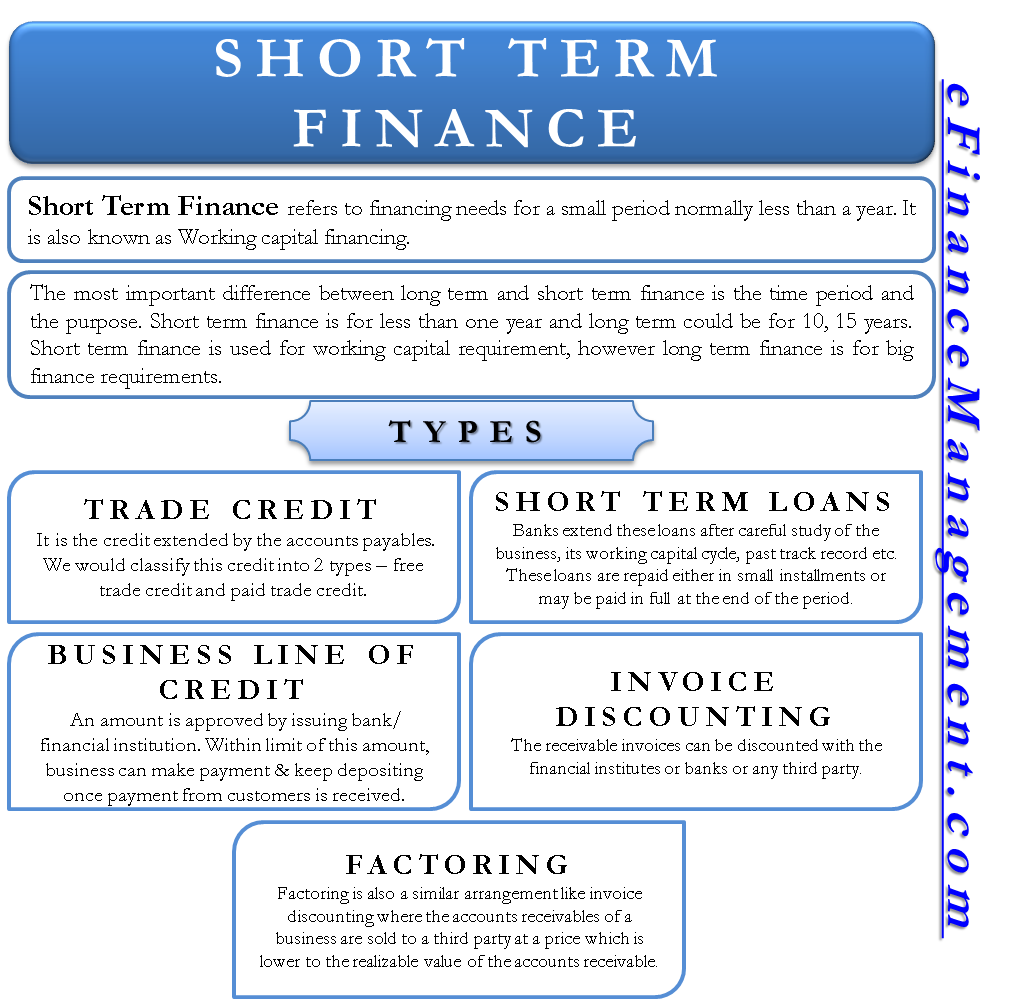

Short Term Finance Types Sources Vs Long Term Efinancemanagement

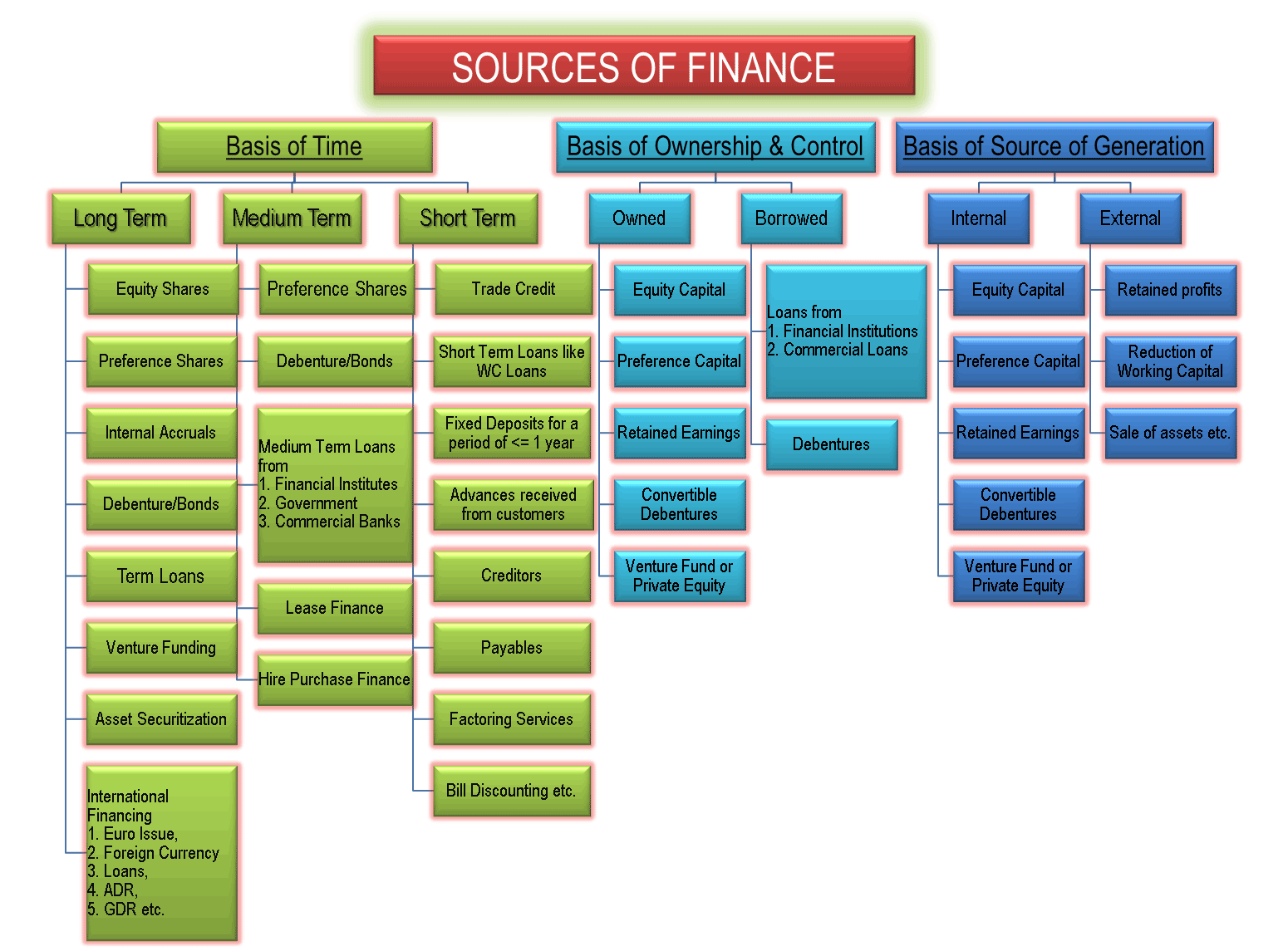

Short-term financing The main sources of short-term financing are 1 trade credit 2 commercial bank loans 3 commercial paper a specific type of promissory note and 4 secured loans.

. Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations. Contracts when business declines. Trade credit is when a seller ships goods to a firm without requiring immediate payment.

Name and describe 4 commonly used sources of short-term financing. Short-term financing means business financing from short-term sources which are for less than one year. Trade credit A firm customarily buys its supplies and materials on credit from other firms recording the debt as an account payable.

Issue Equities and Debentures 3 Final Thought. NPV of a long-term investment project. It is an arrangement in which the supplier allows the buyer.

Explore the definition and sources of short-term financing. Name and describe 4 commonly used sources of short-term financing. The same helps the company generate cash for working of the business and for operating expenses which is usually for a smaller amount.

Name and describe 4 commonly used sources of short-term financing. Read More Export-Import Bank of the United States In Export-Import Bank of the United States. Selling Goods on Installment 2 Types of Long-Term Financing 21 1.

This article throws light upon the ten main sources of short-term fund. There are various types of short term sources of finance available in current market. Common sources of short-term financing include.

Retain Profits 23 3. 40 of short-term financing is in form of AP or trade credit. Describe how managers use NPVs when evaluating capital.

To inject small amounts of cash to carry a company so that it does not run out of cash between successive major private equity financing. Accounts Receivable Financing 13 3. Short-Term Bank Loans they are usually due in 30 to 90 days.

Under a bank loan the financial institution shall specify the loan tenure. This type of financing offers working capital to purchase inventory. Overdraft facility is for a short-term span.

The main major ways which one could use to raise short term sources of finance include. See the answer See the answer done loading. The entrepreneur gives some collateral in exchange for the bank loan.

Spontaneous source of funds. Short-Term Sources of Finance Trade Credit Bank Credit Public Deposits Accrual Accounts Factoring and Advances from Customers The main sources of short-term finance are as follows. Allows reduction in price if payment is made within time period.

The major sources of short term finance are discussed below. The four basic types of financial ratios used to measure a companys performance are liquidity ratios asset management ratios leverage ratios and profitability ratios. The four commonly used sources of short-term financing are trade credit factoring short-term bank loans and commercial paper.

Short-Term Source of Finance 1. There are some of the sources of short term financing which you might not be aware of it. Short-Term Bank Loans they are usually due in 30 to 90 days.

The short term sources of financing are explained in detail as follows. Another perk to using trade credit for short-term financing is that these transactions can improve your business credit. Inventory financing is another ideal short-term financing avenue that product-based small businesses might consider.

As well as the timing amount of repayments and interest rate. All of the above. Trade credit is one of the traditional and common methods of raising short-term capital from the market.

Short term financing examples. To carry distressed companies while searching for an acquirer or larger investor in which case the lender often obtains a substantial equity position in connection with the loan. Short-term financing The main sources of short-term financing are 1 trade credit 2 commercial bank loans 3 commercial paper a specific type of promissory note and 4 secured loans.

Now we shall briefly discuss the various sources of short-term finance. -extended for 30-60 days. Trade credit is a common source of short-term finance available to all companies.

Factoring firms can also obtain short- term financing by using the services of a factor. Customer Advances 14 4. 1 Types of Short Term Financing 11 1.

Bank loans serve as a long-term mode of financing entrepreneurial business. Name and describe 4 commonly used sources of short-term financing. Spontaneous Sources of Funds certain sources of funding arise naturally during the normal course of business operations.

It involves developing money by online loans lines of credit and invoice financing. Commercial banks or bank credit. This problem has been solved.

Main Sources of Short-term Finance The short-term financial needs of the companies are generally met from the following sources. Short-term financing refers to any revenue source such as a cash advance or invoice financing that is paid off in less than one year. Long-Term Loan from a Bank 22 2.

Advances from customers. Documentary Letter of Credit Revocable Letter of Credit Finance against Securities Fixed Letter of Credit Purchasing and Discounting of Bills and more. It refers to the amount payable to the suppliers of raw materials goods etc.

Deferred income is a source of short term financing whereby a business receives payment in advance before delivering the agreed upon services or.

Short Term Financing Definition Example Overview Of Top 5 Types

Sources Of Finance Owned Borrowed Long Short Term Internal External

What Is Short Term Financing Definition Sources Advantages And Disadvantages The Investors Book

0 Comments